BTC Price Prediction: Bullish Trends and Long-Term Forecasts (2025-2040)

#BTC

- Technical Strength: BTC trades above 20-day MA with Bollinger Bands hinting at volatility expansion.

- Institutional Momentum: News highlights institutional participation (e.g., BlockDAG, El Salvador) as a bullish catalyst.

- Long-Term Scarcity: Halving cycles and fixed supply underpin multi-year price appreciation potential.

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

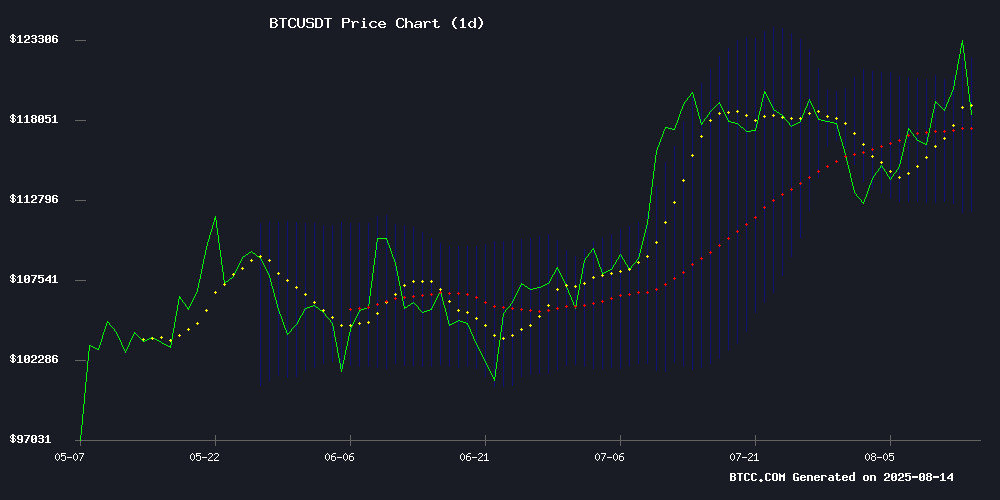

According to BTCC financial analyst Robert, Bitcoin (BTC) is currently trading at 117,213.59 USDT, slightly above its 20-day moving average (MA) of 117,021.26. The MACD indicator shows a bullish crossover with values at 637.85 (signal line) and 1,225.64 (MACD line), though the histogram remains negative at -587.79. Bollinger Bands suggest a potential breakout, with the upper band at 122,054.81 and the lower band at 111,987.71. Robert notes that the price holding above the MA and the tightening Bollinger Bands indicate a potential upward movement in the near term.

Market Sentiment: Institutional Interest Fuels BTC Optimism

BTCC financial analyst Robert highlights that recent news, such as BlockDAG's $1.206M BTC distribution and El Salvador's bitcoin windfall, underscores growing institutional interest. Despite a brief dip below $120K due to US Treasury announcements, the overall sentiment remains bullish. Robert points to Bitcoin's NUPL (Net Unrealized Profit/Loss) suggesting a prolonged bull market, while volatility near two-year lows hints at an impending breakout. The altcoin momentum, fueled by events like BlockDAG's auction, further supports a positive outlook for the crypto market.

Factors Influencing BTC’s Price

Bitcoin NUPL Suggests Prolonged Bull Market as Institutional Dynamics Shift

Bitcoin surged to a record $124,500 before retracing to $121,500, leaving traders divided on whether the pullback signals a healthy reset or the start of a deeper correction. The Net Unrealized Profit/Loss (NUPL) metric—a key indicator of market sentiment—shows a departure from historical patterns, suggesting a more gradual ascent this cycle.

Unlike past bull runs where NUPL peaks preceded sharp reversals, current data reflects tempered profit-taking behavior. Analysts attribute this shift to growing institutional participation and the stabilizing influence of US spot Bitcoin ETFs. Long-term holders now appear less prone to panic selling, creating a more resilient market structure.

While short-term volatility persists, the NUPL trajectory implies sustained bullish momentum. All eyes remain on whether bitcoin can consolidate above key support levels as the market digests its latest all-time high.

BlockDAG Distributes $1.206M in BTC to 10 Winners, Fueling Altcoin Momentum

BlockDAG has redefined community incentives in the crypto space with its 10 BTC auction, distributing over $1.206 million to ten participants. The event underscores the project's aggressive reward structure and growing presale traction, which has raised $374 million at a current batch price of $0.0276.

The auction sets a new standard for altcoin engagement, combining verifiable payouts with a 2,660% ROI since its initial batch. Such metrics position BlockDAG as a standout in a crowded market, where tangible value distribution increasingly separates contenders from pretenders.

Block Introduces Modular Bitcoin Mining System and Open-Source Fleet Management Software

Block, Inc. has unveiled the Proto Rig, a modular Bitcoin mining system designed to redefine the industry's hardware standards. Unlike traditional disposable mining equipment, the Proto Rig offers a durable, upgradeable solution with a lifespan projected to extend beyond a decade. Its modular design allows for individual hashboard replacements, reducing upgrade costs by 15-20% and slashing repair times from days to seconds.

Thomas Templeton, Hardware Lead at Block, highlighted the innovation: 'Mining hardware hasn’t really changed in years. Machines break often, are hard to repair, expensive and time-consuming to upgrade, and don’t make the most efficient use of power or space. With Rig, we set out to change all of that–and contribute to hardware decentralization in the process.'

The Proto Rig also boasts 1.5 times the power density per rack foot compared to legacy systems and maintains compatibility with both modern and existing mining infrastructure.

In tandem with the hardware launch, Block introduced Proto Fleet, an open-source fleet management software platform. The software integrates power scaling and diagnostic tools, further enhancing the efficiency and scalability of Bitcoin mining operations.

US Bitcoin Reserve Plans Face Complications Amid Confiscation Strategy

Treasury Secretary Scott Bessent outlined a vision for a Bitcoin Strategic Reserve funded through confiscated assets rather than direct purchases. The proposed reserve, estimated at $15-$20 billion, faces immediate hurdles—Bitfinex repayments could slash holdings to $12.5 billion, while lingering custody scandals cloud transparency.

On-chain data reveals $23.6 billion in government wallets, but disputed ownership of 85% of custodied tokens fuels market uncertainty. The asset forfeiture pipeline, though robust, introduces operational complexities that may delay federal implementation despite state-level crypto initiatives gaining traction.

Strategy and El Salvador Reap Massive Bitcoin Windfall Amid Record Rally

Bitcoin's ascent to a historic peak above $124,000 has turbocharged the portfolios of corporate and national holders alike. MicroStrategy (now rebranded as Strategy) now sits on $77.2 billion in BTC holdings—a figure that dwarfs its 2024 valuation of $41.8 billion. The enterprise's 628,946 BTC stash, acquired at an average $73,301 per coin, represents a 40-fold multiplication of its initial 2020 investment.

El Salvador's pioneering bet on bitcoin as legal tender has paid equally spectacular dividends. President Nayib Bukele disclosed a 155% profit on the nation's holdings, with its $300.5 million position ballooning to $768.85 million. Blockchain analysts note the country's dollar-cost-averaging approach WOULD have delivered 115% returns to retail investors mimicking its strategy.

Bitcoin Dips Below $120K After US Treasury Rules Out New Purchases

Bitcoin retreated from record highs after US Treasury Secretary Scott Bessent confirmed the government won't add to its crypto reserves through market purchases. The flagship cryptocurrency dropped 4.6% to $118,730 following the announcement, paring gains after hitting an all-time peak of $124,457 earlier Thursday.

The policy clarification came during a Fox Business interview where Bessent outlined the Treasury's strategy: "We're not going to be buying that, but we are going to use confiscated assets and continue to build that up." This approach leverages cryptocurrencies seized in criminal cases to grow what WHITE House advisers describe as a "digital Fort Knox."

Market reaction was immediate, with Bitcoin surrendering its intraday gains. The Treasury currently holds between $15-20 billion in Bitcoin reserves at current valuations, according to Bessent's estimates. All sales of seized assets will cease under the new policy.

Bitcoin vs. Altcoins: Q3 Crypto Gains in Focus as Dominance Shifts

Bitcoin's rally to a $123,000 all-time high has failed to sustain its dominance, with capital increasingly rotating into altcoins. The BTC.D metric has declined from 65% to 59% over two months despite BTC's 15% price surge, signaling a potential altcoin season.

TOTAL2's breach of $1.65 trillion—the highest since 2021—confirms altcoins' relative strength. Market-wide pullbacks remain Bitcoin-driven, with BTC's $50 billion market cap dip mirroring the broader crypto market's contraction.

Traders are monitoring this divergence closely. Bitcoin's consolidation NEAR $120,000 support suggests structural validation, but weak intraday momentum raises questions about Q3 leadership. The third consecutive lower low in BTC.D indicates altcoins may outperform in the coming quarter.

BlockDAG’s 10 BTC Auction Draws Mainstream Attention with $1.206M Prize Pool

BlockDAG has catapulted into the spotlight after distributing $1.206 million to ten winners in its 10 BTC Auction, a MOVE that transcends crypto circles and captures broader financial interest. The transparent payout, verified by wallet addresses, underscores the project’s credibility amid a presale surge—$374 million raised and 25 billion coins sold, marking a 2,660% ROI since its initial batch.

The auction’s scale rivals the largest presale rewards in crypto history, with Bitcoin’s current valuation amplifying its media appeal. Finance and tech outlets are seizing on the narrative: a high-stakes prize pool tied to a project redefining presale potential. For investors eyeing the top crypto for 2025, BlockDAG’s momentum and audacity demand attention.

Bitcoin Retreats from Record High but Bullish Sentiment Endures

Bitcoin tumbled 5% during Thursday's US session after reaching a new all-time high of $124,500 in Asian trading hours. The selloff followed US Treasury Secretary Janet Yellen's dismissal of plans to expand strategic BTC reserves, instead favoring reliance on confiscated holdings.

The cryptocurrency now faces its steepest single-day decline since mid-June, with technical indicators flashing warning signs. A bearish engulfing pattern has emerged on daily charts, while BTC struggles to secure a weekly close above the psychologically important $120,000 level.

Near-term support appears at the 200-hour moving average near $118,000, where temporary consolidation is forming. Yet the broader technical picture remains decidedly bullish - daily Ichimoku clouds maintain support, trend momentum persists, and key moving averages continue their upward trajectories.

Market participants appear to be treating this as a healthy correction within a larger uptrend, with expectations building for renewed attempts at record highs once the pullback completes. Critical resistance clusters between $120,000-$124,500, while downside risks could accelerate below $117,500 support.

Bitcoin's Correction Weighs on Crypto Market Amid Inflation Data

The cryptocurrency market faces downward pressure following hotter-than-expected US PPI data, with Bitcoin's unfinished bullish structure suggesting potential near-term volatility. Analysts observe an abc correction pattern forming after the TOTAL market cap tested the 3.88 trillion support level—a critical threshold that could either stabilize prices or trigger deeper declines toward 3.5 trillion.

Bitcoin's technical setup reveals a promising wedge formation, with wave 5 projections pointing to 130k upon completion. The current pullback in subwave (B) finds immediate support at 117-118k, maintaining the broader bullish thesis. Market participants await either confirmation of continuation patterns or signs of extended correction.

Bitcoin Volatility Nears Two-Year Low as Market Braces for Breakout

Bitcoin's price action has entered a rare phase of equilibrium, with volatility metrics hitting their lowest levels since 2023. The flagship cryptocurrency briefly touched a record $124,500 before retreating to $121,500, sparking debate among analysts about whether this represents weakening momentum or a consolidation before further gains.

CryptoQuant data reveals the 30-day Price High & Low metric - measuring the range between monthly peaks and troughs - has compressed to its tightest level in two years. This technical pattern typically precedes significant price movements, creating what traders call a 'coiled spring' effect. Liquidity pools have concentrated above $120,000 and below $113,000, setting clear boundaries for the next directional move.

Market participants are divided on interpretation. Some point to the volatility squeeze as evidence of institutional accumulation, while others caution that prolonged consolidation at record highs often precedes corrections. The coming days will test whether Bitcoin's long-term bullish trend can overcome this period of exceptionally low volatility.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

BTCC financial analyst Robert provides the following BTC price forecasts based on technical and fundamental analysis:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 150,000 - 180,000 | Institutional adoption, ETF approvals |

| 2030 | 300,000 - 500,000 | Scarcity (halving cycles), global regulatory clarity |

| 2035 | 700,000 - 1,200,000 | Mainstream payment integration, store-of-value demand |

| 2040 | 1,500,000+ | Network effects, Bitcoin as reserve asset |

Robert cautions that macroeconomic factors (e.g., inflation, interest rates) and technological risks (e.g., quantum computing) could alter these projections.